Coalition Loyalty Programs. Should you join one or be one?

- Interactive Rewards

- Nov 17, 2023

- 7 min read

Updated: Feb 15, 2024

“The report of my death was an exaggeration”1

Coalition Loyalty programs, which allow members to earn and redeem points for shopping with multiple retailers, have been restructured in the last decade with new ownership and value propositions for their partners. The offer of ubiquitous reward points earning is as appealing as ever.

If you are a business weighing the choice between buying ‘someone else’s points’ or ‘launching your own program’, consider the journey multi-partner programs have been on, the root causes for the changes and the implications for your investments before committing your hard-earned money.

This discussion will briefly examine the history, transformations, and emerging future of multi-partner loyalty programs and present the critical questions to ask as you ponder the loyalty program question: order in, meal kit or dinner from scratch?

The way it used to be

It was a simpler time before the cloud. Unless you were as big as an airline, loyalty programs meant coffee cards, stamps or outsourcing to a Coalition Loyalty Program operator: A multi-company program run by an independent organisation selling loyalty points to partner companies. The program owner profited from charging a margin for the points and retaining a portion of the value when members converted the points to rewards. Operators did not run supermarkets or airlines; they managed a loyalty program.

The operators existed because large-scale consumer loyalty programs were subject to economies of scale. Technology platforms were expensive, direct marketing costs were high, and curating/managing reward catalogues was a skill few airlines and grocers had. Participating in a larger program where these efforts and costs could be spread over multiple partners was cheaper and faster for each partner.

The opportunity was large, “…in 2010, the coalition model of loyalty programs was predominant around the globe. Loyalty coalitions, in which a third party operated a national loyalty program anchored by a grocer, fuelled by a credit card, and sharing data amongst dozens of partners, seemed like a license to print money.”2 Three companies dominated: Aimia, LoyaltyOne and Payback, two from Canada and the third from Germany. “Between them, the two companies [Amia and LoyaltyOne] managed relationships for nearly a billion consumers around the globe.” 3

Payback, operated by Loyalty Partner GmbH and owned by American Express, survives.4

What happened? Digital technology changed loyalty economics, and customer data was very valuable. The promise of rewards for all spending is a persuasive and popular proposition for customers, so multi-partner coalitions did not thrive; their ownership and income changed.

Cloud-based platforms made it significantly less expensive to manage loyalty programs, and an increasing preference for rewards that can be delivered digitally (cash, gift cards, travel bookings) removed the old economies of scale. Organisations could afford to do their own.

Plus, large partners in the coalitions developed an insatiable thirst for customer data.

Their marketing personalisation efforts matured, and the required first-party customer data was sitting with an external operator, imposing friction.

The inherent value of permissioned data increased as Privacy Regulations tightened, questioning the viability of third-party data sources5.

The largest volume partners, the core contributors to the success of the coalition businesses, decided to go their independent way, or as their pending departure lowered the value of the operator dramatically, acquired it. The notable examples are running with their ‘new’ owners, Nectar with Sainsbury’s, Aeroplan with Air Canada, Aeromexico with Air Mexico, and AirMiles with the Bank of Montreal.

Online Marketplaces arrived

Digital commerce also redefined the way ‘offers’ are presented to consumers. ‘Affiliate Malls’ allow networks of merchants to display promotional incentives, discounts, and benefits to an audience of online buyers.

The audience is provided by ‘publishers’ to create a two-sided market with buyers and sellers. Mall operators charge the merchants a participation fee and a portion of the sale as a performance-based charge. Malls have proliferated, most (online) merchants participate in many, and there is a growing choice of network operators and malls to consider.

Example of a Merchant Offers Ecosystem

Arguably, the largest operator is Rakuten6 in the USA, but Cash Back programs, with their browser extensions, are common.

It did not take long for both Program and Mall operators to realise Loyalty Programs have large audiences and Malls offer value to members at a low cost to the operator. So, the line between Affiliate Malls and Loyalty Programs blurred. Established programs offer malls, and cash-back malls have added aggregation accounts (so they resemble programs, not just markets).

It is a short step from ‘Audience’ to ‘Media Channel’.

Economies of scale may no longer dominate strategy in the operation of Loyalty Programs, but they still apply to data-driven marketing and media channels. The concentration of advertising spending with a small number of large tech companies demonstrates this; “Alphabet, Meta and Amazon now account for more than half of all advertising spending outside of China”7. The concentration of data, technology and talent has made it cheaper for organisations to outsource targeting to large operators, reminiscent of the Loyalty operators of the past.

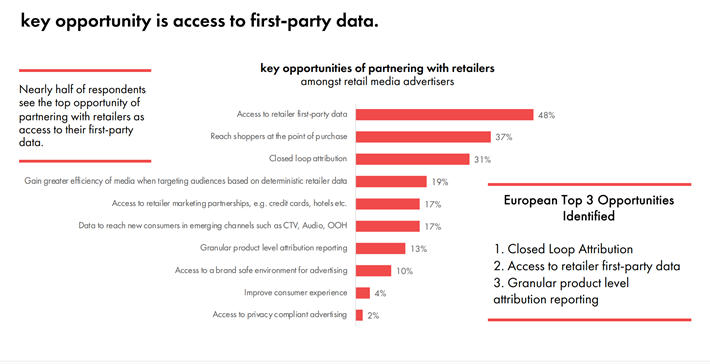

A consumer-privacy backlash has altered these scale economies and opened an opportunity for companies with a large audience who have permitted their data to be used, i.e., Loyalty Program owners. Organisations with large memberships have happily entered the media business, creating new Retail Media companies and the profitability of these organisations explain their proliferation8.

Their ability to accurately attribute sales to advertising spend explains some of their popularity, for example Walmart’s Retail Media company has delivered a 30% improvement in return on digital advertising spending over the last two years to its advertisers9.

Exciting new things to consider when deciding to offer your loyalty program or points in a multi-partner program already engaging with an audience.

We are here to bury Caesar, not to praise him

Customer-centric organisations love their customers, prioritise their needs and are uncomfortable with the idea that the management of the loyalty relationship can be outsourced to ‘strangers’ who treat the process as an automation and efficiency challenge. Good riddance to the Coalition Programs of the past.

But customers love the idea of earning loyalty points for all their spending. They adore it even more when they can decide where to spend their points, and the choices are extensive.

Even the most devout customer-focussed organisation can better serve (and sell to) their customers if they have a wider, more complete set of preference insights, even if it is inferred from where they spend their money. The offers can be more relevant and effectively timed if the program has a wider view of the members. Also, they do not have to be restricted to what we sell. For example, if a member starts buying tubs of ice cream and boxes of tissues, we can suggest our wellness partner send them an offer for a spa day.

If my product is only purchased infrequently, participating in a program that the members use daily increases the chances that my brand will be more easily available when they want to buy in my category.

Large multi-partner programs have more customers than most prospective participants and have permission to promote new brands if they join the coalition. The economics of ‘top of the funnel’ customer acquisition may make the coalition a wise channel choice (even if you also decide to run your own proprietary program).

Scale and intimacy become crucial considerations for offering your own program, joining someone else’s program, or doing both. The strategic imperative remains the same for all options, ensuring that customers buy from you when they buy in your category.

If you do not have a data-based relationship with your customers or cannot identify individuals and their interactions, gathering first-party data and permissions with your own program should be imperative. Establish a value exchange that customers are willing to engage in; data for value.

If you already have rich and extensive first-party customer data because you have a contractual relationship with customers, you have choices.

Invite partners to access your customers through your program, increasing value to your members as the price. If you are successful and the value is compelling, even open the program to non-members as an acquisition channel, like the Royal Bank of Canada10. You gain a richer view of your customer’s behaviour as you add partner data.

Maintain your program but award the points of a larger program with more places to earn and claim rewards to increase network value for your members, like Finnair11. You gain access to the larger engaged audience and the established reward network.

If the appeal of a large, new audience is persuasive, join a multi-partner program, but remember these programs are called Loyalty, not Acquisition Programs. Insist on enough data sharing in the partnership to enable personalisation and engagement with your brand, not just the program. The challenge is retaining the customer relationship and earning gratitude when rewards and recognition are attributed to the program. If not convinced this is practical, consider participating in the Retail Media proposition they offer as proof of value.

Reference:

Mark Twain letter of 1897 to a reporter asking about rumours he was on his deathbed

https://www.linkedin.com/pulse/when-loyalty-giants-walked-earth-rick-ferguson-clmp/

bid

Technically, there are still Coalition Loyalty Programs run by independent organisations in operation. Velocity’s frequent flier program is a separate legal entity from the airline Virgin Australia. Flybuys Australia is operated by Loyalty Pacific, an independent company 50% owned by its anchor grocery and retail partners, Coles and Wesfarmers. These structures are convenient or historic, and members see these programs as ‘belonging’ to the major brand, not as independent programs.

California is leading here again, with Senate Bill 362 pending; the California Delete Act is aimed at Data Brokers marketing customer data not explicitly permissioned. California Delete Act (SB 362) FAQ | by Tom Kemp | Aug, 2023 | Medium

Rakuten: Online & In-Store Cash Back | Shop 3,500 Stores!

Google and Meta lead global digital advertising growth (thenationalnews.com)

“PwC forecasts up to A$1.2 billion in ‘new’ revenue will enter the Australian advertising market over the coming five years, taking a relatively nascent market from A$850 million to A$2.14 billion at a CAGR of 20.1 percent based on the mid-point forecast.” Retail Media State of the Nation 2023 – IAB Australia

a marketer’s love life (mailchi.mp)

https://www.retailbankerinternational.com/news/rbc-extends-its-loyalty-programme-to-all-canadians/

https://www.iagloyalty.com/news-insights/iag-loyalty-partners-with-finnair

This article was first published by Customer Strategy Network. Permission to use has been granted by the publisher.

.png)

Comentários